By

Tri Duc

Mon, June 24, 2024 | 4:13 PM GMT+7

The Nasdaq listing of Vietnamese EV maker VinFast via a $23 billion reverse merger with a US-based SPAC represents the largest merger and acquisition (M&A) deal globally in 2023.

This noteworthy information was highlighted in the United Nations Trade and Development (UNCTAD) World Investment Report 2024, released just last week. The VinFast deal not only showcases the vigor of the Vietnamese market but also signifies a pivotal moment for the EV sector on a global scale.

VinFast Auto, the automobile division of Vietnam’s leading private conglomerate, Vingroup, has carved out a remarkable niche in the competitive landscape of electric vehicles. This success aligns with the growing demand for sustainable transportation solutions worldwide.

VinFast makes its Nasdaq debut, August 15, 2023. Photo courtesy of Vietnam News Agency.

Despite the impressive performance of the automotive sector, the overall value of M&A deals in developing economies dropped significantly in 2023. There was a reduction of $31 billion year-on-year, bringing the total to $76 billion, which accounted for nearly half of total global Foreign Direct Investment (FDI) inflows during the same period.

On a global scale, M&A sales in 2023 reached $378 billion, marking a staggering 46% decline year-on-year, with 6,717 deals recorded—down 13%. Notably, the automotive industry bucked this downward trend, achieving a sales value of $31 billion, a sharp increase of 273% from the previous year. The VinFast deal significantly contributed to this rebound in the automotive sector.

Reviewing the manufacturing landscape, the UNCTAD report noted a shift in investment patterns among major multinational enterprises (MNEs). Notably, these companies have halved their greenfield investments in China since 2019, primarily due to escalating trade tensions. Companies such as Hon Hai Precision Industry (Foxconn) and Samsung Electronics are reassessing their manufacturing strategies, opting to expand their operations into other markets, including Vietnam, India, and Mexico. Remarkably, Foxconn has tripled its number of manufacturing projects in Vietnam.

According to UNCTAD data, FDI inflows into Vietnam reached $18.5 billion in 2023, a noticeable increase from $15.5 billion in 2018. This upward trend signals a growing confidence in Vietnam’s economic landscape, which has seen consistent annual increases: $16.1 billion in 2019, $15.8 billion in 2020, $15.7 billion in 2021, and $17.9 billion in 2022.

In terms of regional rankings, Vietnam’s FDI inflows are the third-largest in Southeast Asia, trailing only Singapore at $159.7 billion and Indonesia at $21.6 billion, as highlighted by UNCTAD.

Source: UN Trade and Development (UNCTAD)

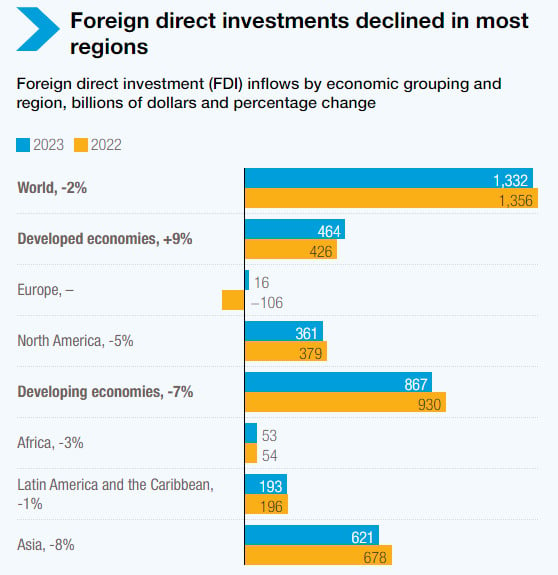

Furthermore, global FDI flows saw a slight dip of 2%, totaling $1.3 trillion in 2023. This decline reflects broader trade and geopolitical tensions affecting a sluggish global economy, particularly as the overall headline figure would have shown a decrease exceeding 10% if not for a few European conduit economies that registered significant fluctuations in investment flows.

The report emphasizes that FDI flows to developing countries also faced challenges, decreasing 7% to $867 billion in 2023. This underscores the need for robust strategies to attract and retain investment in these economies, particularly amidst a shifting global economic landscape.

(function(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//connect.facebook.net/vi_en/sdk.js#xfbml=1&version=v13.0&appId=3168341520106228”;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));