By

Prof. Nguyen Mai

Tue, September 2, 2025 | 7:00 am GMT+7

Amid the volatile geopolitical and economic landscapes worldwide, Vietnam’s leadership has proactively pursued policies favoring innovations. As a result, the country has reaped significant achievements, with foreign direct investment (FDI) becoming a bright spot in its socio-economic picture, writes Prof. Nguyen Mai, former Vice Chairman of the State Committee for Cooperation and Investment.

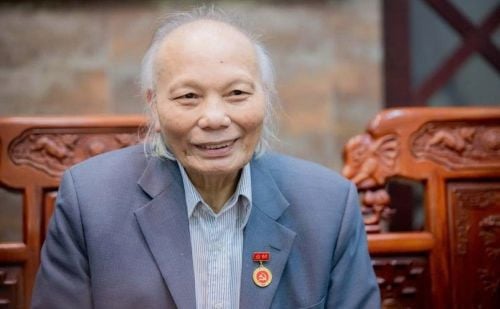

Prof. Nguyen Mai, former Vice Chairman of the State Committee for Cooperation and Investment and former chairman of Vietnam’s Association of Foreign-Invested Enterprises (VAFIE). Photo by The Investor.

Global FDI Trends

The landscape of foreign direct investment globally has undergone significant changes, especially in light of declining investor confidence. According to the United Nations Conference on Trade and Development (UNCTAD), FDI flows fell for the second consecutive year in 2024, deeply affected by geopolitical conflicts and global trade tensions. Secretary-General Rebeca Grynspan noted that such tensions act as a “poison” for investor confidence, causing FDI transactions to slide by 11% when excluding transit economies in Europe.

Interestingly, the inclusion of transit hubs reveals a different story: global FDI surged by 4%, reaching a monumental $1.5 trillion. Among developed economies, there was a steep decline in Europe with a staggering 58% drop in FDI, while North America saw a robust 23% increase largely spearheaded by the U.S. This year, Southeast Asia, with its recorded inflows of $225 billion, emerged as a leading market, also paralleled by remarkable growth in Africa.

ASEAN’s FDI Momentum

Southeast Asia’s appeal as a global FDI destination remains strong, raking in a record $230 billion in 2023. Most investments directed towards manufacturing, particularly in sectors such as electric vehicles and electronics. Industry professionals like Yun Liu from HSBC attribute this spike in production within ASEAN to shifts in global trade records in recent years.

Indonesia has been a significant player, attracting approximately $94 billion between 2022 and September 2023, driven primarily by investments from China, Taiwan, and the U.S. with multinational companies employing a “China + 1” strategy to diversify their supply chains. Furthermore, Stephen Bates from KPMG emphasizes ASEAN’s continued role as a major hub for electronics production, enjoying immense investments from global tech conglomerates.

Renewed investments in high-value electronics such as semiconductors underscore the region’s commitment to not only innovating but also promoting sustainable growth. The digital milieu—data centers, 5G networks, and green technologies—is drawing a plethora of investments, propelling forward Vietnam’s significant potential in this area.

VSIP Industrial Park in Bac Ninh province, northern Vietnam. Photo courtesy of VSIP.

Vietnam’s FDI in 2025

As per the government’s Resolution 226 dated August 5, 2025, Vietnam targets a GDP growth of 8.3% to 8.5% for the year, with inflation kept under 4.5%. The government aims to mobilize a staggering VND2,800 trillion (approximately $162.28 billion) in investments for the second half of the year, including a target of drawing in VND1,500 trillion in private funding along with an anticipated $18 billion in registered FDI.

The semiconductor industry illustrates Vietnam’s growing role in global technology advancements. While businesses in the semiconductor supply chain are primarily found in the U.S., EU, Japan, South Korea, Taiwan, and mainland China, Vietnam has positioned itself concentrically to benefit from manufacturing processes like assembly and testing, establishing itself as a significant player in this high-value industry.

In 2024, Vietnam’s semiconductor sector is projected to generate $18.23 billion in revenue, with the nation emerging as a pivotal service hub for technology giants like Intel, Samsung, and Hana Micron. As of 2023, this growing industry made Vietnam the third-largest semiconductor exporter to the U.S., an indicator of the country’s expanding footprint in high-tech manufacturing.

However, to solidify its place and avoid stagnation, Vietnam needs to deepen its involvement in advanced, knowledge-based sectors that yield higher value. The Semiconductor Industry Development Strategy aims to firmly place Vietnam at the center of the global semiconductor scene with aspirations of having at least 300 design firms, three semiconductor manufacturing plants, and 20 packaging facilities by 2050.

This strategic direction aims to harness Vietnam’s current strengths while laying a robust infrastructure for future accomplishments, with the objective to master research and drive semiconductor innovations.

Recommendations for the Business Community

Recognized as the core sector of the electronics industry, the global semiconductor market has witnessed impressive revenue growth. The upcoming opportunities that Vietnam aims to tap into hinge on regulatory advancements and infrastructure enhancements in the semiconductor space.

At a recent conference focusing on the semiconductor workforce, stakeholders spotlighted the pressing need for Vietnam to accelerate its strategic implementation. Enterprises are encouraged to stay vigilant about domestic regulations, particularly those supportive of investment. Vietnam is currently adapting its policies to align with international standards while also incentivizing fresh investments into high-tech sectors.

Additionally, the competitive landscape for talent in the semiconductor arena remains precarious, with a forecasted need for an additional one million skilled professionals by 2030. Vietnam currently lacks adequately qualified engineers, a vacancy that must be filled urgently. There is a crucial demand for a revised talent strategy, focusing on partnerships with educational institutions to nurture a skilled workforce ready to meet the demands of this critical industry.

As the fabric of the technology, media, and telecommunications sector evolves rapidly, companies must adapt to both competitive pressures and the dynamics of the labor market while positioning themselves effectively for a promising future within the semiconductor industry.

* Prof. Nguyen Mai is also former chairman of Vietnam’s Association of Foreign-Invested Enterprises (VAFIE).