ESG (environmental, social, and governance) matters are among the key priorities for foreign businesses in Vietnam to facilitate business expansion while meeting sustainable development goals. However, there is plenty of scope for companies and government stakeholders to work together to deliver optimal economic development outcomes. In this article, we briefly discuss findings from the VBF’s survey of foreign business stakeholders in Vietnam, including progress and concerns over ESG priorities.

ESG, short for environmental, social, and governance, represents the three primary criteria for investors to assess a company’s sustainability. As Vietnam steadily attracts foreign direct investment (FDI), manufacturers and foreign-invested enterprises have begun actively participating in the country’s ESG initiatives to foster sustainable growth and meet high compliance standards in key export markets.

Nevertheless, challenges persist in Vietnamese firms effectively implementing ESG strategies, partly due to differing perspectives on the government’s commitment to ESG and the nascent market-based mechanisms.

Addressing these challenges, the Vietnam Business Forum (VBF)—a structured and continuous policy dialogue platform between the Vietnamese Government and the business community—initiated a study to gather and analyze the ESG perspectives of foreign companies operating in Vietnam.

In this article, we discuss key findings of the VBF report, providing insights into the current state and evolution of the Vietnamese business landscape, including the focus on ESG targets.

Start exploring

Background

In Vietnam’s dynamic business environment, companies are increasingly acknowledging the importance of employee well-being and social equity. More than half of all businesses operating in the country are actively addressing these crucial aspects. Notably, 20% of these businesses allocate over 5% of their budget specifically for ESG initiatives. These focused endeavors are reinforced by established risk assessments and robust data governance structures.

The VBF conducted the comprehensive study in two phases: one in October 2023 and another in February 2024. During these phases, a total of 655 responses were gathered from foreign business leaders operating in Vietnam. These insights form the foundation of the VBF report, shedding light on the ESG landscape and its implications for foreign companies in the Vietnamese market.

Foreign businesses often encounter challenges as they strive to expand and implement ESG strategies. Some of these hurdles are:

- Market-based mechanisms are not mature: The Vietnamese market is still in the process of developing a robust ESG framework. While progress has been made, there remains room for improvement in creating market-based mechanisms that incentivize sustainable practices.

- Assessing diverse perspectives: Foreign companies operating in Vietnam often grapple with differing opinions on ESG priorities. Balancing global best practices with local considerations can be complex, especially when navigating cultural nuances and regulatory variations.

Key Findings of the VBF Report

FDI is a Major Source of Growth in Vietnam

According to data from the Ministry of Planning and Investment, newly registered FDI in Vietnam decreased by 11% in 2022 year-on-year (YOY); however, an uptick was observed in 2023, with FDI disbursement reaching a record high of USD 23.18 billion, the highest in five years (2019-2024).

Currently, the sentiment among foreign businesses appears neutral, with the outlook for the manufacturing sector being less optimistic than other sectors.

ESG Momentum Among Foreign Businesses in Vietnam

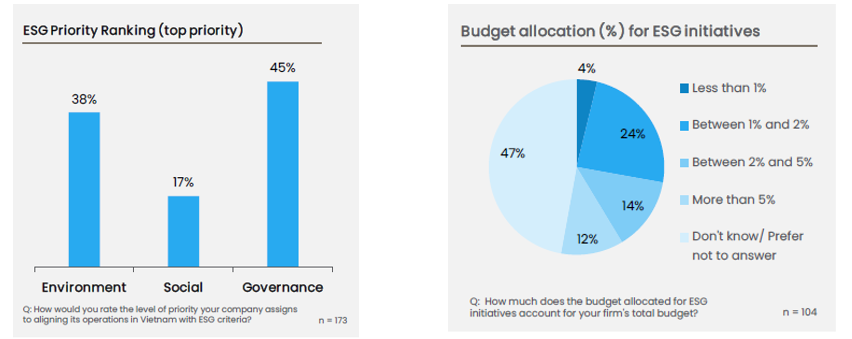

Foreign businesses operating in Vietnam exhibit distinct priorities when aligning their operations with ESG criteria.

Governance takes center stage for many companies, focusing on compliance, certainty, and risk management. Effective corporate governance structures are recognized as pivotal in ensuring ethical business practices, transparency, and accountability.

Small businesses tend to prioritize the social aspect as their primary ESG focus, encompassing safety, working conditions, and community engagement. Their commitment to social well-being reflects their local impact and community ties.

European businesses, including those in the process of setting ESG targets, will face new European Union Directives like CBAM [Carbon Border Adjustment Mechanism], Deforestation [EUDR], and CSRD [Corporate Sustainability Reporting – 2022/2464/EU]. These directives will reshape how businesses report and address their environmental and social impact. – Pathway towards a sustainable economic recovery, VBF, March 2024

Other findings from the VBF report include:

- Approximately 80% of businesses already have an ESG strategy in place, either developed by global headquarters or tailored locally.

- Among those with a local ESG strategy, around 34% have actively implemented these strategies—an encouraging sign of progress.

- 60% of businesses have established a board-level governance structure specifically for sustainability matters.

- Nearly 60% have defined specific ESG targets to guide their actions.

- 60% of businesses allocate funds for ESG initiatives, particularly among larger enterprises.

- 68% consider sustainability matters in their risk assessment processes; however, only 13% reported seamless integration of risk management with specific ESG objectives.

These findings indicate that businesses are currently in the early stages of adopting ESG data governance and reporting practices. The path forward involves continued refinement and alignment with global best practices.

In the second phase of the study, a deeper understanding of the current state of ESG initiatives and the level of commitment among the international business community in Vietnam is revealed.

Key findings include:

- Over a third of businesses find themselves in the monitoring stage, underscoring the need for concrete actions to accelerate ESG implementation.

- Nearly half (46%) of companies with ESG targets demonstrate their commitment by setting time-bound goals; over a third have linked ESG to management KPIs—a positive sign of organizational alignment.

- Over 60% of businesses prioritize employee well-being.

- Nearly half (47%) of companies have made carbon reduction commitments.

- 35% of businesses have specific targets related to energy sourcing; over 40% of manufacturing companies in Vietnam have set green energy targets.

- Around 25% of businesses have targets aimed at tackling waste and water management challenges.

These findings highlight both progress and areas for further development in ESG practices in Vietnam.

Challenges and Opportunities in Expanding ESG Initiatives

The VBF report indicates that market-based mechanisms have not yet significantly influenced foreign businesses’ ESG initiatives in Vietnam. To enhance ESG prioritization, it is crucial to establish such mechanisms. Improved access to green finance, current infrastructure, and maturing upstream supply chain components would facilitate foreign businesses’ successful implementation of environmental initiatives.

Additionally, a comprehensive and transparent regulatory framework plays an important role. Currently, Vietnam has room for improvement in this area.

Moreover, there exists a gap between foreign businesses’ expectations regarding government support for ESG and actual progress. Only one-fourth of businesses express confidence in Vietnam’s commitment to sustainable and green development. When seeking government backing for their ESG efforts, financial incentives and regulatory relief rank high on their list of expectations.

Recommendations for Government Stakeholders

Despite businesses appearing less confident regarding continued FDI potential, Vietnam continues to stand as an alluring investment destination. Notably, companies express heightened revenue expectations for the first half of 2024.

To sustain attractiveness, ongoing reforms are essential, focusing on cultivating a high-quality workforce, improving institutional frameworks, and easing access to land and capital. This strategic approach will accelerate economic growth and build a resilient and progressive economic foundation.

Furthermore, Vietnam should actively promote market-oriented solutions that make green technologies—specifically for energy, waste management, and water treatment—readily available. This enhances environmental sustainability and attracts ESG-focused companies, a growing segment in today’s globalized market. Demonstrating alignment with these standards is vital to attract FDI seeking to establish new operations or expand existing ones. Regulatory changes and well-designed financial incentives, like tax breaks and grants, can further encourage foreign firms to adopt global sustainability practices within Vietnam.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia.

For a complimentary subscription to Vietnam Briefing’s content products, please click here.

For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.